It’s been almost two weeks since Carson Block's Muddy Waters report on Sino-Forest accusing the company of fraud.

I’ve been following the case even though I no longer have stakes in the game. There has been an interesting back and forth going on in the comment section of this blog and on other message boards. So here’s another post so that discussion can continue.

A few comments on where I think things stand.

1. The MW report

Substance aside, the report is poorly written. It’s self-serving. (Example: “Were Muddy Waters not to have come along, it is likely that this fraud could have continued for a few more years and billions of dollars more” – is this really necessary?). That lowers its value.

There’s information that is irrelevant to the company’s current situation. For example does some deal gone bad in 1994-96 have any bearing on the company’s value today? Probably not, it’s only there to establish a “pattern” of deceit. Lumping all this together in the report is confusing.

But the main elements of the fraud theory are there. The con itself: inflating profits and assets. The mechanism of that fraud: the use of opaque and undisclosed “authorized intermediaries” to fabricate transactions and profits, instead of selling directly (which would leave a paper trail). Finally, the cover up: a convoluted corporate structure to distract the auditors and manipulating the valuation process of its forests.

That’s MW’s theory. It’s not outlandish and certainly we’ve seen bolder scams go undetected for much longer. It could be wrong, of course, as is the case with every theory.

Now a lot of people are asking MW to “prove” their theory. That’s tremendously unfair. To do so, MW would have to have access to all of Sino-Forest’s records and books and be sure they were the “real” ones. That’s not going to happen.

They also can’t ascertain completely the scale of the scam, for the same reason. It could be that MW’s right and billions in assets are missing, or it could be more (or less).

The report says as much (“…without the aid of law enforcement, we will never really know how much money is there or where it went.”). You can’t fault them for that either.

What MW did was look at the evidence and put the pieces together for their theory (feathers, waddle, beak…hmmm).

Mr Block is being “made the villian” by those on the other side of the trade, which again, in my opinion, is unfair. Among other things there is a line of thought, that regardless of the outcome of investigations, Sino-Forest has been “mortally wounded” by his allegations.

Now, frankly the whole idea that you can “destroy” a company by spreading “false” rumors or information is hogwash. If the information turns out to be incorrect, then the company was what it said it was, and the markets will value it accordingly. If the allegations are true, a fraud has been exposed (hard to see the downside in that!). Even financial institutions, which are deemed to be more sensitive to “breaks in trust”, usually bounce back quickly once the air has cleared.

Sino-Forest’s stock has tanked. But lets be clear, a stock price does not a company make. Certainly not in the short run.

2. Company Rebuttal

After initially ignoring the allegations, the company took steps to address the situation. To look into the allegations they appointed an independent committee. That committee is only independent in the sense that it is comprised of “independent” (i.e. not working for the company) board members, but hardly “independent” in a third party sense, since those directors are probably still liable if fraud is present (self-incrimination, anyone?). The committee will be “assisted” by PriceWaterhouseCoopers, which is a good idea since using Ernst & Young, the company’s auditors, who also may be looking at some hot water, would hardly be independent enough.

Still, it’s important that PwC produce and sign off on any report for it to have any kind of credibility. Statements by the company or documents produced by the company without any third party independent (really independent) verification are automatically suspect.

The report is expected to take at least three months to complete.

The company also made some documents and information available to analysts and the public, but kept secret about others, such as its customers’ names and the location of its forests. That’s ok. They have no obligation to disclose this information to analysts or anyone else. When regulators and auditors come knocking, however, that’s a different story.

3. Others Chime in (or not)

The analyst at RBC Capital Markets, Paul Quinn, came out Friday (June 10th) with a very favorable opinion (Outperform – Evidence mounting in Sino’s Favour). Another analyst Richard Kelertas at Dundee (Canadian Firm, recently acquired by Scotiabank) called the MW report “a pile of crap” and was quite adamant in his support of the company (“we believe in the company, we trust the company). Of course, these guys have their reputation at stake since they have been following and recommending the stock for years. Since 2004 in Kelertas’ case and RBC has had an outperform on the stock since May 2009. Both firms reportedly did underwriting for Sino in its 2009 stock offering.

But they are not the only ones who did business with Sino. Credit Suisse, Merrill, Morgan Stanley and others were bookrunners on Sino bond and stock deals. So you can’t really use that as a rationale for the analysts’ positions. No, these guys truly believe what the company is telling them. I can relate. When I worked as an analyst there were some companies I followed for up to ten years and weren’t followed by anyone else. The execs knew me and I knew them. They’d show me the installations, tell me anecdotes and give me certain information that would never be “on the record”. Friends? Maybe. There was a certain empathy. The work’s easier when it’s not confrontational. But let there be no doubt about it, they would lie to my face if that’s what was their interest. And they did. After you get duped a few times, you learn to be a little less trusting and keep some distance.

Other analysts have been somewhat more skeptical. Annisa Lee, an analyst at Nomura Securities had put out a skeptical report already several months ago, well before the MW report. (and was reportedly cut off at today’s conference call). Morgan Stanley’s Vivien Gui also released a note (which didn’t get much press from what I see), which was called “my unanswered questions” and spotlighted doubts about the company’s scale, the location of its forests and the business model.

Then there is the enigmatic presence of Paulson with his large position. He is obviously attentive to what is going on, and reportedly has been supportive of the company. Unfortunately, he is “trapped” in a sense. Here’s why: my first impression was that Paulson should get his hooks in the committee and in the investigative process, to better assess where he stood. Ah, but by doing so, he would become an “insider” with the legal implications that that entails and thereby freeze his position. So, aside from laying blind bets in either direction, Paulson doesn’t really have any option but to wait.

At this point, the only ones who really know the situation are the company insiders. That is probably only a handful of execs. If there is fraud, the outside directors are probably clueless. (I’ve been on boards, the information you get is distilled more than a good scotch whisky). Ernst & Young, the company’s auditors, should know by now if they have been duped. You can bet that the first thing they did when this broke was to call in the Sino audit team and go over every sampling and every piece of independent verification that may be missing or suspicious. If something important got past them before, they now know what it was. Unfortunately since E&Y’s nuts are in the boiler, they won’t utter a word until they have checked and re-checked EVERYTHING. Don’t expect them to talk anytime soon. But they know…already.

4 The Bond Angle

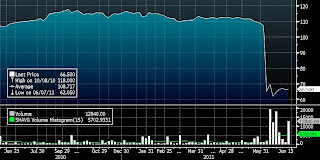

Sino’s stock hit a new low today, but since I like to blog about fixed income and there aren’t a lot of bond blogs out there, I thought I’d chime in on some interesting movements in Sino’s bonds.

The 2014 bonds which my clients held (and the 2017s which they didn’t) have stabilized in the 60-70% range since their initial fall. One could interpret that as players assessing the best case scenario (no fraud full recovery) and the worst (partial recovery even if stock goes to zero) and looking for some middle ground.

2014 Bonds

The 2011 bonds, however, have rebounded sharply from a low in the 60% range to a recent price of around 90%. There would appear to be another dynamic weighing in this case. These bonds are due Aug 17 and there is only $87 million outstanding. Therefore, even if investigations finally reveal that Sino is a fraud, there’s a good chance these bonds could be paid before the results of those inquiries come to light. A play on the lack of expedience of the due diligence, if you will.

2011 Bonds

I’m not recommending it, but there’s is an alternative for Sino bulls to simply going long the stock, if you want to take it.

That’s where the Forest stands (or doesn’t) at this time. The other comment thread was getting too long, so please continue that fine discussion here. Go at it, just keep it civil.

I don't think that I necessarily come down on the side of Sino Forest, but something about this whole scalping thing bothers me, (even if the short sellers are revealing frauds.) I guess the way that I look at it is that if I knew that Stanford's bonds were bogus, but ignored this and sold them to people anyway, then my actions would have contributed to the fraud. In the same way, the short sellers are acquiring well researched (inside?)info on cons and then selling puts into the inflated market. While eventually, their investigations causes fraud to come to the end, it's not until they've magnified the damages by selling paper to buyers who they know are suckers. While it's easy to say buyer beware, I think it's strange that if someone whose long sells bogus stock, they are committing fraud, but if you sell bogus stock short, then you are some kind of a hero. Ultimately, we do need short sellers rooting out this info, but what difference does it make if I'm long or short the Brooklyn bridge, if I know that someone is going to lose a fortune from the transaction?

ReplyDeleteThe key to the "morality" angle, IMO, is the inside aspect. There's a difference between "figured-out" as in well-researched and inside information.

ReplyDeleteIt's a fine line, but it cuts both ways. You research could find a tremendously undervalued stock and you go long and reveal your findings to the world. It's up the world whether they follow you or not.

Heroic? Hardly. Did you earn the spoils? I'd say yes.

Alex--imho this post is considerably more incisive than the first one. Kudos. You're getting better. (In part because of my oddly inspirational ranting?) Still, it pains me that you glossed over the bit about Carson's research itself being a fraud--filled with willful over the top hyperbole and wild, unfounded conjecture. That's the the real morality angle. It isn't that he shorted the company and profited, it's that he lied, and published a report he knew to be largely false. As to Sino itself, my guess--yes, guess--having read the transcript of the con call is that the "fraud" is limited to the taxes that the AIs have presumably dodged thus far, which Sino will now be held accountable for since MW has shined a spotlight on them and the PRC will soon come a knocking. At this price though I can't resist. Went long today at $3.15. Gonna shut my eyes until September/October unless I get a quick pop.

ReplyDeleteOne more thing I wanted to address--the notion that a viable company can be destroyed by a specious report isn't quite "hogwash". Sino is still completely reliant on the ability to raise capital--it's a babe in utero sustained by an umbilical cord. Essentially, MW's report was like if a two-bit lawyer walked into the room dressed o.r. scrubs and told the mother (investors), "Your baby has AIDS, M'am. Not you. Just your baby. But you might contract it soon if you stay connected so it needs to come out, now." So what does mom do? Well--she thinks it's a real doctor, so she assumes he's telling the truth and just FREAKS out. She grabs a scalpel and forceps off the table, carves the baby out of her belly, and severs the cord with her incisors. (Too much Charlie Sheen?) Thus, based on the word of one crackpot fake doctor, a healthy baby dies. . .

ReplyDeleteJust sayin.

I wager that Ernst and Young is colluding with Sino Forest and is liable (morally so, hopefully legally too).

ReplyDeleteJust do some digging and you'll know what I mean. The more you dig, the more you'll know what I mean.

Someone in this blog mentioned the politician Anthony Weiner. He just resigned, continuing his honorable conduct.

ReplyDeleteWill Sino Forest?

There seems to have been a complete silence on the subject of replanting. Most countries, including China do not permit industrial logging without a replanting plan. Sino Forest declared in their recent Q1 accounts that the lease charge for the replanting is $80 per hectare per year for 30 years. For the 266,000 hectares they declared "purchased" in Q1 the contingent liability for replanting lease costs amounts to $640 MILLION and that was just for Q1. The economic model is very flawed and has to be a fraud because the revenue for felling the fully grown trees is a fraction of the costs of restoration of the forest over 30 years.

ReplyDeleteRegarding the last comment, I don't think I follow your math showing that replanting would be uneconomic. As I undertand it, the company generally agrees to pay about $50 per cubic meter of wood when it agrees to purchase a plantation, or about $4500 per hectare (based on slightly under 100 cubic meters per hectare). If they then have the right to pay $80 per year per hectare to use the land to replant trees, assuming the can achieve yields of 100 cubic meters per hectare in 10 years or so (both achieveable as I understand it - in fact using company claims this could be very conservative), their land rental cost per hectare would be about $900, considerably less than the $4500 they paid for the standing timber initially. Of course they would also have replanting and maintenance costs and this doesn't consider the time value of money, but if you netted everything out I would still be very surprised if replanting and growing their own trees wasn't in the end lass expensive than their initial standing timber purchase.

ReplyDeleteNot taking a view on whether of not this is indeed a fraud, just saying I don't think you can conclude it is based on your comment.

@ Anonymous at 12:51

ReplyDeleteWhile I don't disagree with your basic premise, it would behoove you to use competitors' figures, rather than ones from a company whose credibility has been called into question.

@ WellRed at 3:54

ReplyDeleteAgreed - for a better argument I should be using independant numbers. However, I was just trying to demonstrate that using the company's numbers doesn't necesssarily lead to the conclusion that the replanting model is flawed, as the post before mine did.

Might be hard for some to believe, but there is a chance all their numbers are correct, their model is sound, and the business is run with integrity. I've seen lots of somewhat faulty analysis trying to demonstrate that can't be so for one reason or another, but I think to be consistant one has to look at all of that evidence with just as much a critcal eye as one has to look at the company's arguments and "evidence".

Dear Delano and Others,

ReplyDeleteDYU here (I'm back). Few random thoughts:

(1) Sino Forest likened to a baby!? That's one heck of an old baby. 17+ years and going strong.

(2) LISTEN TO THE CONFERENCE CALL. PLEASE, LISTEN. I eat my own cooking and have listened to it twice now. Tell me what you think.

(3) If you think the CEO looks like a choir boy...I agree. Since when do fraudsters 'look' it? In my experience chronic liars are not so distinguishable.

(4) Have you considered that even without fraud, the company's stock might be worth < $1.00 in the event that construction slows down in China? It's not hard to imagine a perfect storm of asset markdowns, freezing of credit markets, etc. The asset/liability mismatch could have a classic run of the bank-esque outcome.

(5) Don't go long based on your opinion of Muddy Waters. Do your homework. If you don't, I don't recommend going long other than for a trade (and a day trade to boot). Heck given the volatility the last few days, even I've been tempted to go long just for a intra day trade (I did not). Note however that you risk the possibility of a halt of indefinite time on the stock. You risk being a bag holder.

Just reading a twitter from CNBC saying Paulson firm sold stock in Sino Forest due to uncertainity over disclosures...ahhjajaja.. This dude Paulson was "very supportive" with the mouth and very fast pulling the trigger.

ReplyDeleteIf this is true, I assume Sino is cooked, done, bye bye, arrivederci, saludos!!

Yep. Zero Hedge has a confirming document.

ReplyDeleteThis duck is cooked! At least Paulson thinks so.

http://www.zerohedge.com/article/paulson-dumps-all-sino-forest-holdings-750-million-realized-loss

On a long enough timeline, the survival rate of everyone drops to zero.

ReplyDeleteZero Hedge is a joke, that site is full of doom and gloomers and nothing excites the crowd over there more than the failure of established figures. They mocked Paulson for owning the stock, and now that he dumps it that's supposed to mean something? They glorify Muddy Water for their investigative research, but where's the piece about the vindication of ONP?

ReplyDeleteThings certainly don't look good right now Sino Forest, that's because in this market you're guilty until proven innocent. I think the company will be proven innocent of most of these charges. They've been more proactive than any of the alleged frauds out there in addressing the issues, and few of MW's allegations really stand on its own, you have to have an imagination to justify them.

By the way for those who are short, just look at HRBN and you'll see what can happen when you short a beaten down stock that's been accused of fraud. If Sino is ultimately vindicated, while the stock may never fully recover, I expect it to be at least 4 to 5 times higher than where it closed today. So short at your own peril.

Delano, any thoughts?

ReplyDeleteYes. Paulson leaving strikes me as very damning. Have to presume he caught wind of an odious scent, though there is really no new news here other than his departure. The Globe and Mail article was just MW report redux--the same accusations (sino forest is lying about its timber) and the same retort (you idiots don't understand our business model) The market just wants to see Sino Forest beaten to death--nobody cares about its guilt or innocence--it's just sheer bloodlust, boredom, and the love of getting to bash Paulson. A Gladiatorial spectacle for the idiot groundlings. The story for now is that Block is the underdog and champion of the people....eventually, the tide will turn and everyone will be screaming for his blood, just like they did with Paulson. Meh. Whole thing leaves an awful taste in my mouth, had enough. Took half off the table after a 5% pop last week, then got brutalized this morning and dumped for a loss of about 2k. In other words, eating my crow and moving on. Figure I'd better get a few more winning trades in before the world ends so I can stock up on Spam and flashlights.

ReplyDeleteP.S. Baby analogy was farcical--meant to irritate Alex for indirectly calling my posts "hogwash". My posts may be hogwash, Sir, but I think you owe me a little gratitude for spicing up this blog a bit.

Hi Delano. Read a bit more carefully. I called a concept "hogwash" (that you can "talk down" a company). That's an opinion, you don't have to take it personally. I have no problem with your posts. To bad Sino took you for a loss, as it did with me.

ReplyDeleteThe spice is nice, BTW. Thanks.

The WSJ just posted one of the best comments I have seen yet on Sinoforest and other China public company concerns (no offense to the great posters on this Blog... there have been many great comments here as well).

ReplyDeletehttp://online.wsj.com/article/SB10001424052702303936704576398981372541602.html?mod=googlenews_wsj

I think this hits the nail right on the head: China corporate structures are necessarily complex, and while this gives wrongdoers plenty of scope to do their thing, perfectly legitimate companies will be employing the same structures. So how to tell one from the other?

It is not surprising Western shareholders break out in a cold sweat upon reading about these complex arrangements and transactions, but they may indeed be a necessary part of conducting business in China. (as an aside the interesting thing to think about is whether short-sellers have been astute enough to realize the panic that could ensue if they broadly publicized these complex arrangements at some Chinese companies, even if they knew all along that these structures were not something that necessarily proved anything evil was going on).

Anon @ 1:43 PM, thanks for the link to the article. That was my initial impression too, that there are necessary complexities that outside investor don't understand. Whether or not you should invest in a company that operates in a shaky regulatory environment with poor transparency is a debate for another day, but to punish a stock to this extent when 95% of people who are condemning don't even understand how business works in China just seemed like a major overreaction. The worst is priced in, and I think there's a better than fair chance that Sino will turn out to be legitimate.

ReplyDeleteCheck this out :

ReplyDeleteCharlatan Exposed: Seeing the Sino-Forest for the Trees — Part 1

http://www.metalaugmentor.com/eforum/?p=6994

I checked it out...it looks better than it is. I submitted some critical comments and they're 'awaiting moderation' while comments posted well after I did are there. I smell censorship.

ReplyDeleteAnon @ 10:50 AM, please eloborate. What where the nature of your comments? I'm guessing you found fault with their logic or underlying data and calculations - just curious.

ReplyDeleteAnybody still think Carson Block is on the level after today's action on SPRD. Market finally realizing the guy is full of S*&t? God I hope so.

ReplyDeleteSomething is up...over $3 million shares bought right before the close today (thursday)...its getting interesting. I sold my shares at a significant loss but looking to buy back in..keep an eye on this stock...s'thing is brewing, it seems...

ReplyDeletehttp://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=29926504&l=0&r=0&s=TRE&t=LIST

Wellington Management buying into Sino Forest is actually a good contrary indicator. They've 'invested' in not 1 but 5 China fraud stocks...all of which by now are delisted/halted. China Biotics is the most recent. Sino Forest is next.

ReplyDeletejust so all my old friends here know I wasn't a mindless permabull, I am returning to tell you that I am currently stacking puts on the SPY with everything I've got. We are already in a recession as the revised (read: un-doctored numbers) will prove six months from now, Euro zone break up is a matter of when not if, unemployment is going to spike next month (so much so that they won't even be able to fudge a good number,) and corporate profits have nowhere to go but down from here given the bear markets abroad. Even if Ben comes out of his groundhog hole to announce the end of winter later this month it won't matter--the blow up in Europe is going to kill the temporary buzz of Qe3. After that the markets tank, cap gains evaporate for the end of the year and municipal budgets across the U.S. implode. Gonna be a rough couple of years. My advice--ride the gold bubble until they announce the gold tax. Alex--curious, how are you positioning your clients?

ReplyDeleteDelano, I never thought of you as a a permabull...just green on fraud (like 90 percent of people). Looks like your put purchases (if you purchased by/before August 17) was a wise move.

ReplyDeleteI myself bought long-dated out of the money puts on JP Morgan in late July/early August, that doubled in a few weeks (I took my profits; left money on the table, but better safe than sorry).