It’s been almost two weeks since Carson Block's Muddy Waters report on Sino-Forest accusing the company of fraud.

I’ve been following the case even though I no longer have stakes in the game. There has been an interesting back and forth going on in the comment section of this blog and on other message boards. So here’s another post so that discussion can continue.

A few comments on where I think things stand.

1. The MW report

Substance aside, the report is poorly written. It’s self-serving. (Example: “Were Muddy Waters not to have come along, it is likely that this fraud could have continued for a few more years and billions of dollars more” – is this really necessary?). That lowers its value.

There’s information that is irrelevant to the company’s current situation. For example does some deal gone bad in 1994-96 have any bearing on the company’s value today? Probably not, it’s only there to establish a “pattern” of deceit. Lumping all this together in the report is confusing.

But the main elements of the fraud theory are there. The con itself: inflating profits and assets. The mechanism of that fraud: the use of opaque and undisclosed “authorized intermediaries” to fabricate transactions and profits, instead of selling directly (which would leave a paper trail). Finally, the cover up: a convoluted corporate structure to distract the auditors and manipulating the valuation process of its forests.

That’s MW’s theory. It’s not outlandish and certainly we’ve seen bolder scams go undetected for much longer. It could be wrong, of course, as is the case with every theory.

Now a lot of people are asking MW to “prove” their theory. That’s tremendously unfair. To do so, MW would have to have access to all of Sino-Forest’s records and books and be sure they were the “real” ones. That’s not going to happen.

They also can’t ascertain completely the scale of the scam, for the same reason. It could be that MW’s right and billions in assets are missing, or it could be more (or less).

The report says as much (“…without the aid of law enforcement, we will never really know how much money is there or where it went.”). You can’t fault them for that either.

What MW did was look at the evidence and put the pieces together for their theory (feathers, waddle, beak…hmmm).

Mr Block is being “made the villian” by those on the other side of the trade, which again, in my opinion, is unfair. Among other things there is a line of thought, that regardless of the outcome of investigations, Sino-Forest has been “mortally wounded” by his allegations.

Now, frankly the whole idea that you can “destroy” a company by spreading “false” rumors or information is hogwash. If the information turns out to be incorrect, then the company was what it said it was, and the markets will value it accordingly. If the allegations are true, a fraud has been exposed (hard to see the downside in that!). Even financial institutions, which are deemed to be more sensitive to “breaks in trust”, usually bounce back quickly once the air has cleared.

Sino-Forest’s stock has tanked. But lets be clear, a stock price does not a company make. Certainly not in the short run.

2. Company Rebuttal

After initially ignoring the allegations, the company took steps to address the situation. To look into the allegations they appointed an independent committee. That committee is only independent in the sense that it is comprised of “independent” (i.e. not working for the company) board members, but hardly “independent” in a third party sense, since those directors are probably still liable if fraud is present (self-incrimination, anyone?). The committee will be “assisted” by PriceWaterhouseCoopers, which is a good idea since using Ernst & Young, the company’s auditors, who also may be looking at some hot water, would hardly be independent enough.

Still, it’s important that PwC produce and sign off on any report for it to have any kind of credibility. Statements by the company or documents produced by the company without any third party independent (really independent) verification are automatically suspect.

The report is expected to take at least three months to complete.

The company also made some documents and information available to analysts and the public, but kept secret about others, such as its customers’ names and the location of its forests. That’s ok. They have no obligation to disclose this information to analysts or anyone else. When regulators and auditors come knocking, however, that’s a different story.

3. Others Chime in (or not)

The analyst at RBC Capital Markets, Paul Quinn, came out Friday (June 10th) with a very favorable opinion (Outperform – Evidence mounting in Sino’s Favour). Another analyst Richard Kelertas at Dundee (Canadian Firm, recently acquired by Scotiabank) called the MW report “a pile of crap” and was quite adamant in his support of the company (“we believe in the company, we trust the company). Of course, these guys have their reputation at stake since they have been following and recommending the stock for years. Since 2004 in Kelertas’ case and RBC has had an outperform on the stock since May 2009. Both firms reportedly did underwriting for Sino in its 2009 stock offering.

But they are not the only ones who did business with Sino. Credit Suisse, Merrill, Morgan Stanley and others were bookrunners on Sino bond and stock deals. So you can’t really use that as a rationale for the analysts’ positions. No, these guys truly believe what the company is telling them. I can relate. When I worked as an analyst there were some companies I followed for up to ten years and weren’t followed by anyone else. The execs knew me and I knew them. They’d show me the installations, tell me anecdotes and give me certain information that would never be “on the record”. Friends? Maybe. There was a certain empathy. The work’s easier when it’s not confrontational. But let there be no doubt about it, they would lie to my face if that’s what was their interest. And they did. After you get duped a few times, you learn to be a little less trusting and keep some distance.

Other analysts have been somewhat more skeptical. Annisa Lee, an analyst at Nomura Securities had put out a skeptical report already several months ago, well before the MW report. (and was reportedly cut off at today’s conference call). Morgan Stanley’s Vivien Gui also released a note (which didn’t get much press from what I see), which was called “my unanswered questions” and spotlighted doubts about the company’s scale, the location of its forests and the business model.

Then there is the enigmatic presence of Paulson with his large position. He is obviously attentive to what is going on, and reportedly has been supportive of the company. Unfortunately, he is “trapped” in a sense. Here’s why: my first impression was that Paulson should get his hooks in the committee and in the investigative process, to better assess where he stood. Ah, but by doing so, he would become an “insider” with the legal implications that that entails and thereby freeze his position. So, aside from laying blind bets in either direction, Paulson doesn’t really have any option but to wait.

At this point, the only ones who really know the situation are the company insiders. That is probably only a handful of execs. If there is fraud, the outside directors are probably clueless. (I’ve been on boards, the information you get is distilled more than a good scotch whisky). Ernst & Young, the company’s auditors, should know by now if they have been duped. You can bet that the first thing they did when this broke was to call in the Sino audit team and go over every sampling and every piece of independent verification that may be missing or suspicious. If something important got past them before, they now know what it was. Unfortunately since E&Y’s nuts are in the boiler, they won’t utter a word until they have checked and re-checked EVERYTHING. Don’t expect them to talk anytime soon. But they know…already.

4 The Bond Angle

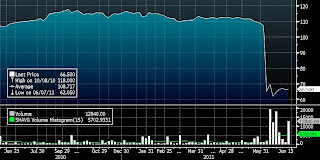

Sino’s stock hit a new low today, but since I like to blog about fixed income and there aren’t a lot of bond blogs out there, I thought I’d chime in on some interesting movements in Sino’s bonds.

The 2014 bonds which my clients held (and the 2017s which they didn’t) have stabilized in the 60-70% range since their initial fall. One could interpret that as players assessing the best case scenario (no fraud full recovery) and the worst (partial recovery even if stock goes to zero) and looking for some middle ground.

2014 Bonds

The 2011 bonds, however, have rebounded sharply from a low in the 60% range to a recent price of around 90%. There would appear to be another dynamic weighing in this case. These bonds are due Aug 17 and there is only $87 million outstanding. Therefore, even if investigations finally reveal that Sino is a fraud, there’s a good chance these bonds could be paid before the results of those inquiries come to light. A play on the lack of expedience of the due diligence, if you will.

2011 Bonds

I’m not recommending it, but there’s is an alternative for Sino bulls to simply going long the stock, if you want to take it.

That’s where the Forest stands (or doesn’t) at this time. The other comment thread was getting too long, so please continue that fine discussion here. Go at it, just keep it civil.